The

Republic of Korea has signed tax treaties (also known as double tax agreements

or DTAs) with a large number of nations across the world, to sidestep double

taxation, avoid tax fraud and boost international trade. After signing of the

first tax treaty in 1970, Korea went on to ink tax treaties with 93 countries till

present.

Further,

for the resolution of issues related to treaty shopping, Korea has made moves

to re-negotiate with various countries that have running tax treaties with

Korea. Its tax treaties with Malaysia (in 2011), Austria (in 2011), Switzerland

(in 2012), Poland (in 2012), India (in 2014), Vietnam (in 2014), Turkey (in

2015), and Czech Republic (in 2016), are examples of re-negotiations.

Furthermore, the content and format of the tax treaty have

undergone numerous changes comprising the latest signing of the multilateral

convention for implementation of tax treaty-related steps for the avoidance of BEPS.

This article summarizes the features of the tax treaty in Korea and

the present situation of the tax treaties that Korea has signed with the

different countries.

New

rules have been framed, that do not permit a tax treaty to be applicable, in

case of a doubt of treaty shopping. The Korean government is into treaties with

other nations for information exchange, which includes tax and finance

information.

Korea’s Corporate Taxes

Tax

Rates for International Firms

Local enterprises are taxed on their global earnings.

Non-resident enterprises with a permanent setup in Korea have to pay taxes only

on the income that they have derived in Korea. Non-resident companies that have

no permanent setup in Korea usually have to pay withholding tax on each independent

commodity of the Korean-derived income.

Tax

on Capital Gains

For residing businesses, capital gains are seen as

ordinary business income and they have to pay corporate tax at normal rates. In

the case of non-resident companies, taxes levied on Korean-derived capital

gains are 11% of sales or 22% of gains (the lower of the two). Usually, there

are no special taxes on profits from mergers.

Capital gains tax on the transfer of stocks is 22%. If

shares are transferred by most shareholders, capital gain of KRW 300 million or

less is taxed at 22% and capital gain more than KRW 300 million has 27.5% attached

to it (for SMEs, the 27.5% marginal tax rate takes effect from transfers actioned

on or after January 1, 2019).

In case of transfer or disposal in less than a year after

purchase by important shareholders (leaving aside small and mid-sized company

stock), 33% capital gains tax is applicable. For small and mid-size company

stock (except holdings of major shareholders), the capital gains tax is 11%.

These rates comprise a local income tax as against 10% of the personal income

tax unpaid.

The Korean government is also reviewing the enforcement

of tax on capital gains from cryptocurrency dealings.

Key

Permissible Deductions and Tax Reliefs

A Dividends-Received Deduction (DRD) applies to

dividends moved between resident firms. Eligible transactions that fulfil the

Tax Incentive Limitation Law can avail a variety of tax incentives, including

investment in high-tech firms or those situated in free trade zones.

The investing company gets a 3-year or a

5-year tax waiver a year after its taxable income’s generation. The business is

then eligible for a 50% tax exemption for two years after the beginning

duration of tax relief.

Exceptions apart, interest paid in the usual business

activities can be deducted provided that the associated loan is used in

commercial activities. A doubtful accounts reserve is permitted in the form of

a tax deduction at the greater of 1% on the tax book value of the receivables

at end-of-the-year, or the effective bad debt ratio (not applicable to

financial institutions).

Specific charities are deductible (as far as under 50%

of the entire taxable income). Entertainment costs exceeding KRW 10,000 on an

event basis via corporate credit card vouchers, cash receipts, or tax invoices

can be taxed.

Launch outlay, like incorporation expenditure,

founders’ salary and registration charges and taxes, are payable if the expenditures

registered for each article of incorporation and are actually paid.

Net operating losses can be deferred for 10 years till 60% of a financial year’s

taxable income (applicable to all businesses except SMEs). Big companies are

not permitted to carry back losses; Nevertheless, SMEs can carry back their

losses to the prior fiscal year.

Other

Corporate Taxes

A capital registration tax of 0.48% (or 1.44% for the

Seoul Metropolitan Area) is to be paid. A property tax of 0.15% to 0.5% (0.24%

to 0.6% with the education surcharge) is imposed on property and buildings for housing

and commercial use. A company having ownership of land worth more than KRW 600

million, is liable to pay a real estate tax, besides property tax.

All agreements regarding establishing, transfer and modification

of rights attract a stamp duty par value. An acquisition tax of 4.6% (including

surcharge) usually adds to the purchase of property, automobile and heavy machinery

(buying a house may enjoy a lower tax rate from 1.1% to 3.5%).

A registration fee between 0.02% and 5% applies on

registration of establishing, modification, or lapse of property rights or

other appellations and incorporation with the relevant agencies.

Tax Treaties in Korea

Tax treaties are global commitments controlled by international law;

like treaties, conferences, contracts and memoranda signed with other nations

in terms of taxes on incomes, capital gains and real estate.

The Korean Constitution gives tax treaties the same power as

domestic legislation in Korea. If there is a dispute between the tax treaty and

the domestic law, the tax treaty is prioritized over the domestic law.

Also, since tax treaties signify that the country’s taxation

authority accepts international transactions under a bilateral agreement, the

Korean government will not levy taxes only based on a tax treaty without the requirements

of the Korean tax law.

Tax Treaties with Other Countries

Double Taxation Avoidance Treaties

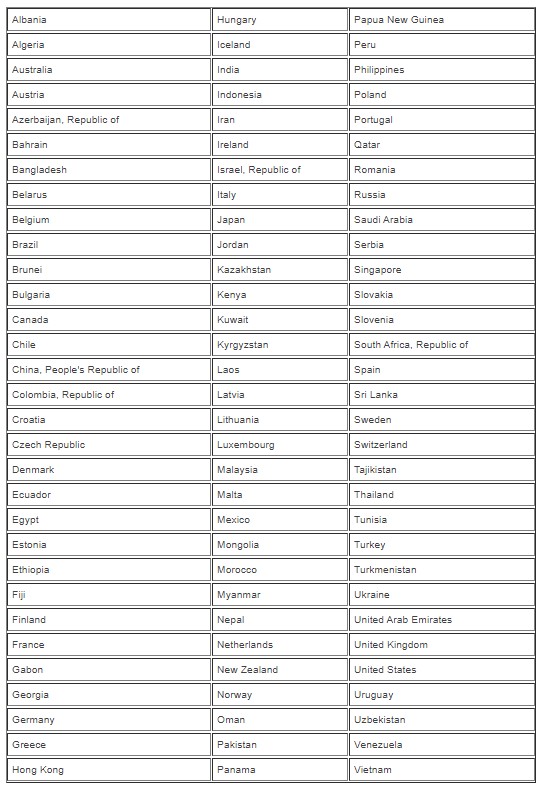

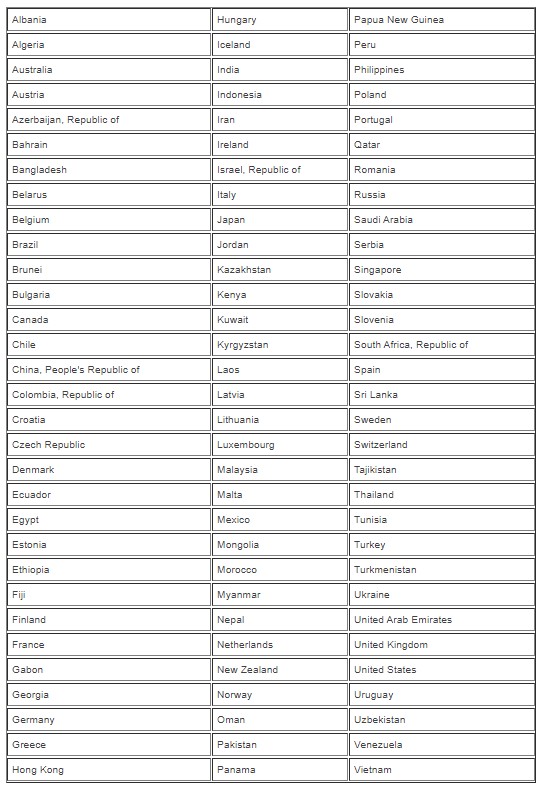

On

and since April 2019, Korea has treaties with the countries listed in the

following table:

Tax Information Exchange

Agreements(TIEAs)

Apart

from income tax treaties, for staying clear of double taxation, Korea has

finalized TIEAs with a lot of countries, inclusive of select tax shelters

and those with whom it has temporary agreements.

TIEA

covers Andorra, Bermuda, British Virgin Islands and the Cayman Islands, among

others. TIEAs has essential information to run and implement domestic tax legislations,

inclusive of particulars of taxpayer registration, enterprise ownership particulars,

companies’ books of accounts and financial records of a certain business deal

and individual or corporate financial transaction information.

Further,

Korea is among the 128 countries to participate in the Multilateral Convention

on Mutual Administrative Assistance in Tax Matters as of April 2019.

Social Security

(Summation) Treaties

Now,

Korea has existing social security treaties with Australia, Austria, Belgium,

Brazil, Bulgaria, Canada, Chile, China, the Czech Republic, Denmark,

Finland, France, Germany, Hungary, India, Ireland, Italy, Japan,

Mongolia, the Netherlands, Peru, Poland, Quebec, Romania, Slovakia, Spain,

Sweden, Switzerland, Turkey, the United Kingdom, the United States, and

Uzbekistan as of April 2019.

Social

security agreements are aimed at helping those who have contributed premiums to

the national pension plans of two separate jurisdictions. Through them, the

countries can avail the combined total periods of coverage in both countries

(i.e., totalisation). However, the agreement has to be evaluated for elaborate

regulations that might differ depending on the corresponding contract.

Conclusion

As the article says, it

is possible for non-residents to apply for a lower tax rate or a tax rebate, based on the tax

treaties.

However, since the tax

treaties and provisions under the Korean tax law are complicated and require

expertise, it is best to discuss their intricacies with tax and incorporation

specialists before applying for the discounted tax rate or tax relief provisions

under the respective tax treaty.

We can help you through all the steps of

understanding the tax treaty that works for you, depending on your country and

its tax equation with Korea. Contact us to help you open a company in Korea.